Financial stability is a pillar of national security.

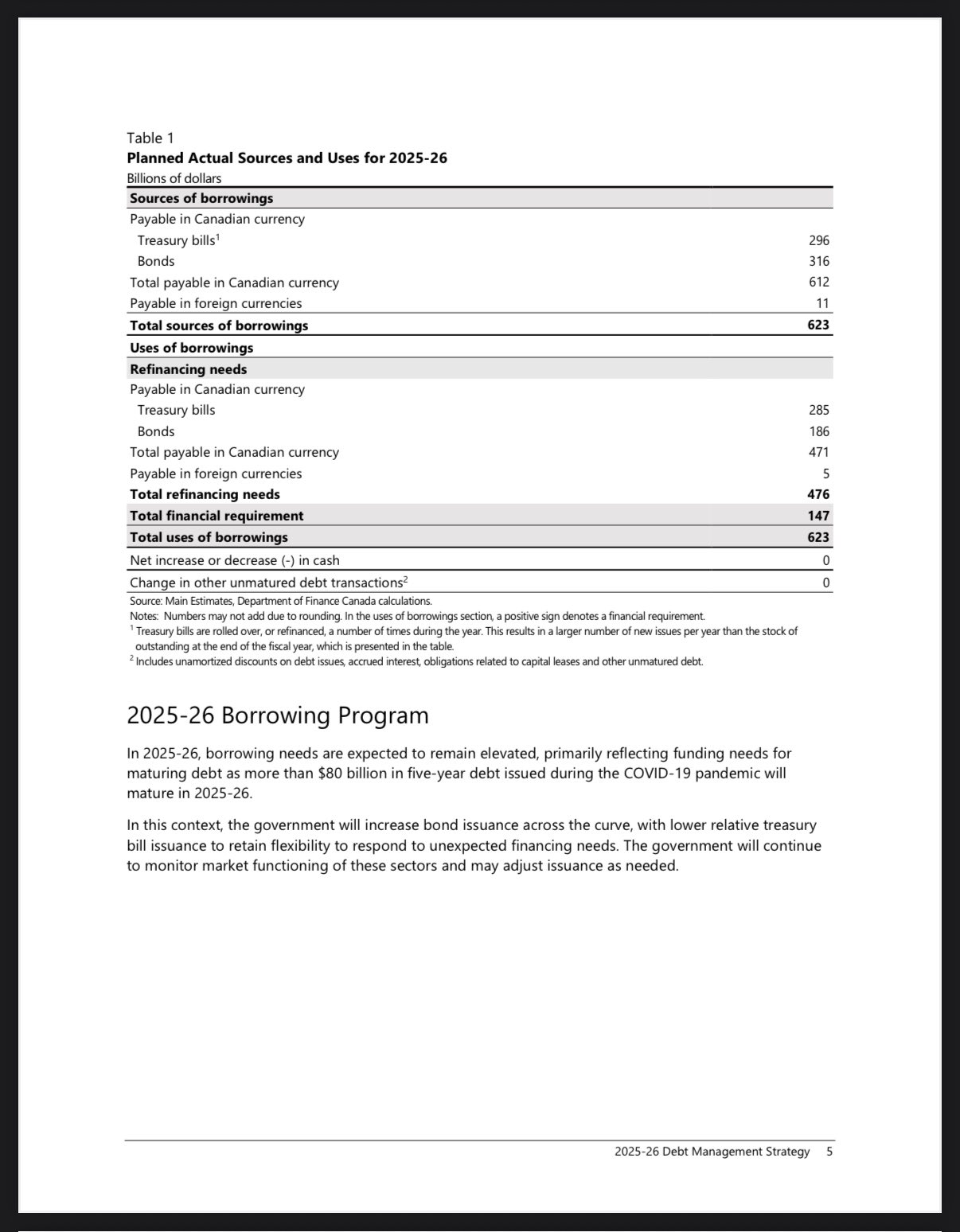

Canada’s debt management strategy tabled by the Department of Finance is requesting to borrow $147 B for 2025/26 (see table 1) and includes $30 B to fund purcases of Canada mortgage bonds.1

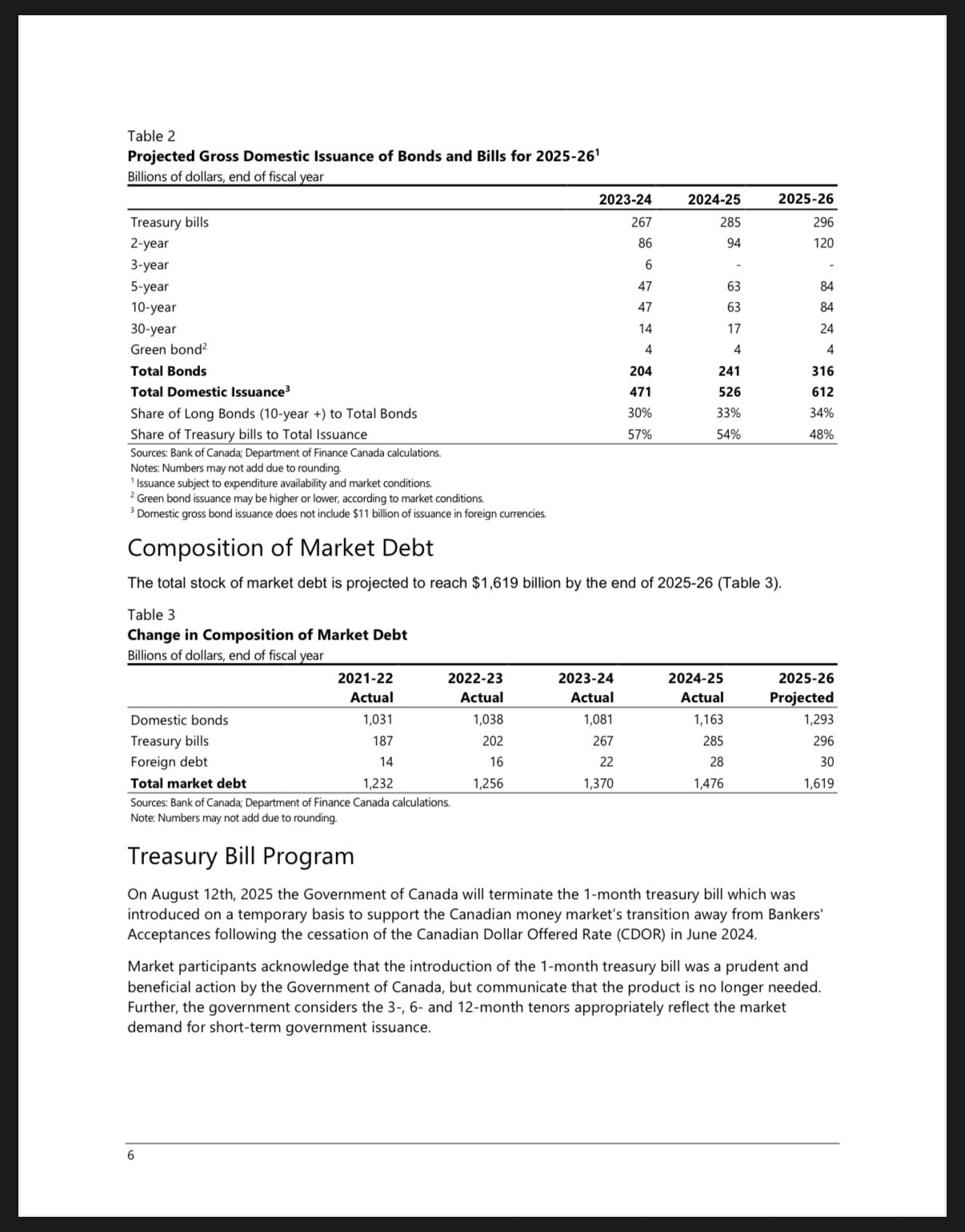

This results in a $1.6 T market debt alone (see table 3).

We remain curious to see what this does to the Canadian dollar and economy.

With the GC already planning permanent position cuts over the next 3 fiscal years estimated at a total of almost $20 B,2

- 26/27 (7.5%);

- 27/28 (+2.5%, totaling 10%); and

- 28/29 (+5%, totaling 15%),

plus executing job cuts this fiscal 25/26 at various departments and agencies:3

- ESDC (800 jobs at Service Canada, Passport);

- CRA (3000 jobs over the past few months including 280 permanent positions; last fiscal year 6656 jobs were cut);

- IRCC (unknown positions); and

- more that are not yet public plus job cuts from last year,

coupled with:

- the number of homes for sale;

- US foreign policy volatility and US trade tariffs;

- the job market shrinking;4

- the cuts to consultants;

- the impact to new university graduates for the next 4 years with unforgivable debt; and

- inflation which is likely to continue increasing,

we wonder what this will do to our:

- housing market (in which rests the majority of Canadians retirement);

- general retirement investments (RRSPs and other cash);

- the value of CAD currency;

- insolvency rates across Canada; and

- the rest of the Canadian economy.

Indeed, that was a long sentence!!

- Released July 16, 2025 https://www.canada.ca/en/department-finance/services/publications/debt-management-strategy/2025-2026.html ↩︎

- FinMin Champagne sent letters to the ministers, informing them of the next three fiscal year job cuts, https://cupe.ca/carneys-cuts-threaten-services-and-jobs-help-our-communities-thrive ↩︎

- https://psacunion.ca/1100-jobs-cut-service-canada-and-cra-threatening ↩︎

- https://www150.statcan.gc.ca/n1/daily-quotidien/250404/dq250404a-eng.htm ↩︎